Your Risk Management controls haven't been this important to your Insurers for 15 years!

Our origins are in the insurance world, and we work closely with a number of partners, both insurance companies and insurance brokers. This gives us an insight into developments in the Insurance Market and the issues these can create for our clients. We also understand how some of these can be addressed. At this time, your risk management controls haven't been this important to your Insurer for 15 years!

What's changed?

The insurance market operates in cycles based on the same supply and demand principles as any other market place. When there is an oversupply of the product (too many insurance companies), prices are driven down; when supply is reduced or demand increases, prices rise.

Insurance has some unusual facets, principally that it sets the price for its product without knowing its final product 'costs', most significantly the cost of future claims. With insurance that covers bodily injuries, such as employers and public liability, it can take several years before Insurers know whether their pricing is right or not. So pricing is not quite as simple as for other products or services which adds complexity.

At present, the insurance market is going through a change in the supply/demand equation. Supply has reduced with Insurers pulling back from, and in some cases out of certain insurance products. There are a number of underlying factors to this such as the impact of the Grenfell Tower disaster and the change in the way personal injury awards are calculated (The Ogden Tables) and of course the impact of Covid-19 (Lloyds of London is set to pay out $4.3bn in losses).

In reality, the insurance market has been under-priced due to excessive competition for the last 15 years and now that is changing; the choice of insurers is reducing and pricing is increasing.

Insurer risk appetite and pricing

Our insurance partners tell us a 'good risk' can expect to pay between 10-20% more, but a business with poor-risk features or poor claims experience, a great deal more.

Larger risks that require more than one insurer to cover their risk exposures face further challenges as insurers look to reduce their risk exposures.

Some occupations, for instance, architects, are facing eye-watering increases to the professional indemnity costs (Grenfell).

In the last 2 weeks, one market-leading insurer announced that it would no longer insure certain manufacturing trades, thus reducing supply even further.

With the current economic backdrop, none of this is welcome.

So what can you do about this?

- Make sure you demonstrate the quality of your risk management, that you are a good risk!

- Make sure you talk to your Insurance Broker about this and share the information with them!

What is a good risk?

A good risk will, in part, be defined by how well the business manages its risk. Insurance and risk management are bedfellows when it comes to this; risk management allows you to reduce the likelihood or consequence of risk - it is the proactive treatment of risk. Insurance, or risk transfer as it is also known, is the reactive risk treatment - it responds when a risk materialises (if insured).

Now is a time when its really advantageous to evidence the quality and extent of your Risk Management controls, processes and procedures and here are some of the things that Insurers are likely to react positively to and why.

"Testable" business continuity plan

So, let’s first draw the distinction between a business continuity (BC) and disaster recovery plan – the latter helps you recover from a disaster – how you respond after the event. A business continuity plan seeks to minimise the likelihood of disruption first by creating business resilience around its process.

There will be many businesses that can produce a document called a Business Continuity Plan (BCP), but a good proportion of these are just documents, and don't materialise on the ground as a series of business continuity protections, resources and arrangements that can be deployed "in the event of".

The reason this is important for insurers is that in the event of a major loss, the largest part of the claim is usually the " Loss of Profits" sustained by the Business whilst it recovers its operations. The longer this takes, the more customers will be irrecoverable, the larger will be the Loss of Profits claim.

So, a business that has robust business continuity arrangements in place (not just disaster recovery) that are regularly tested, both in terms of exercising the plan but also testing and monitoring that all of the arrangements are in place and operative on an ongoing basis, represents a much more attractive risk to insurers. They not only have a plan to recover the business but they also actively look to minimise the likelihood of it happening in the first place.

It's also useful for insurers to understand a business’s tolerance for disruption, recovery objectives and its chosen BC Strategies. These are all indicative of a business that has thought through how to respond in an incident, that is looking to protect itself and keep its customers rather than relying on an insurance policy to pick-up the financial consequences.

These should all be detailed in the BCP.

And if you are ISO22301 certified make sure this information is known!

Health & Safety Management System

Insurers are used to being told that a client has risk assessments, but there is a significant difference to a suite of documents and a management system in place where the risk assessments' control measures are regularly and proactively monitored.

According to one of our insurer partners

"inadequate risk assessments are the root cause of 40% of Employers Liability claims"

you can see the importance of an insurer's perspective.

The same would also be true for any safety sampling carried out using checklists. For example, a checklist used to drive housekeeping standards is a positive risk feature given that slips, trips and falls are among the highest causes of workplace accidents.

Both of the above can generate performance metrics (see below) and can be invaluable data to share with Insurers.

It is also good to highlight how the corrective action is identified where there are 'non-compliances' and how they are addressed; this is further evidence of a proactive approach.

Where such safety sampling relates to fire protections, this will also be a positive feature as it protects the assets and resources of the business as well as the people.

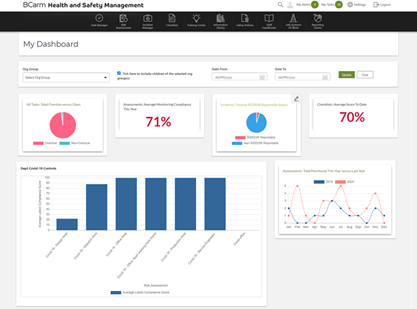

If you use a management system like BCarm, many insurers are beginning to understand how the functionality it provides helps the proactive management of risk.

Again, if your Health and Safety Management system is certified to ISO45001this is relevant!

Training Records

Training Records

Creating risk awareness in the workforce is a key element in any health and safety organisation.

Having records that are either “signed” received and understood – as with BCarm Safety Briefings is a key factor from a claims defensibility perspective.

Equally, training delivered by E Learning can evidence both the quantity delivered and completion rates, as well as competency levels.

If your E Learning includes a self-assessment element as BCarm's does, this can also provide invaluable risk data and a risk performance metric, that illustrates the risk at an employee level.

Risk Performance Metrics

Risk Performance Metrics

As we discovered in our recent webinar on H&S Performance Metrics, these aren’t the norm, with less than 50% of those that attended having performance metrics in place.

Performance metrics are either lead indicators or lag indicators; the former telling you what could happen, allowing you to influence it, the latter, what has happened (accident statistics).

This is information Insurers rarely see and is certainly NOT THE NORM. A business that produces and uses lead performance metrics represents a very positive risk feature.

How long will this last for?

The last market correction occurred in 2001 with the collapse of an Insurer and the 9-11 Attacks, and it lasted for 3-4 years. We live in a very different world today and one where risk seems even more at the forefront of everyday activity.

One thing is for sure, the better-managed businesses who can demonstrate the quality and proactivity of their risk management arrangements will fare the best.

The above are standard deliverables from BCarm, so if you want to discuss how to present this information to your Insurance Broker, then scroll down the page and book a meeting with our team.